Introduction:

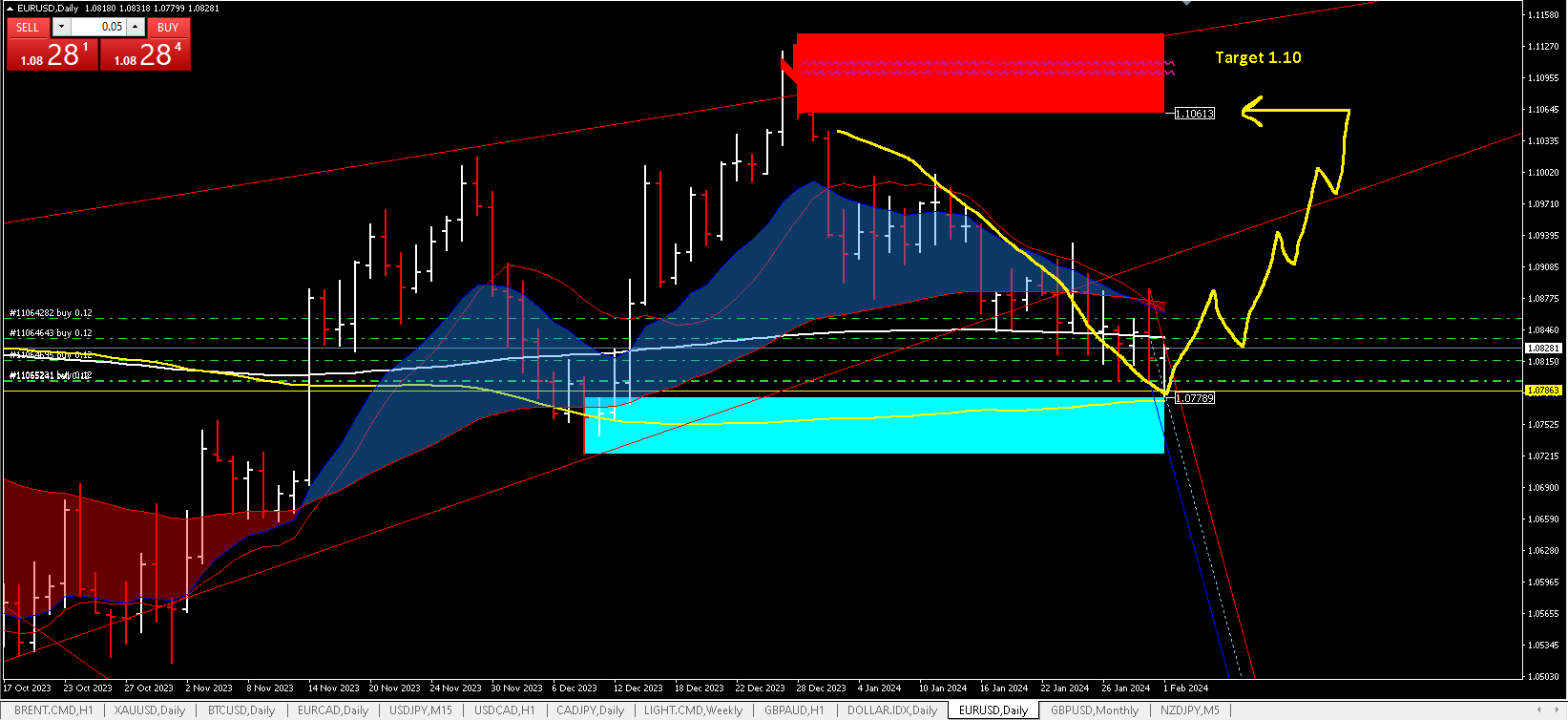

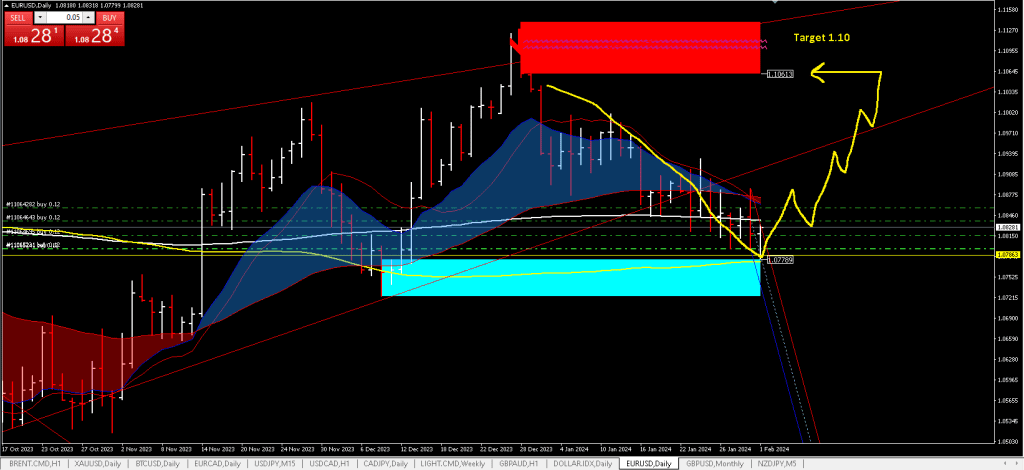

As the holiday season concluded, the EUR/USD witnessed a retracement from its recent peak of 1.1141. Notably, as of January 31, 2024, the Euro found support in a robust demand zone spanning from 1.0724 to 1.0776.

Federal Reserve’s Impact:

In the latest development, the Federal Reserve maintained interest rates at 5% during their recent session, signaling a cautious approach by withholding any rate cuts in March. Emphasizing the need for more data, the Fed indicated a focus on achieving the 2% inflation goal.

EUR/USD and DXY Projections:

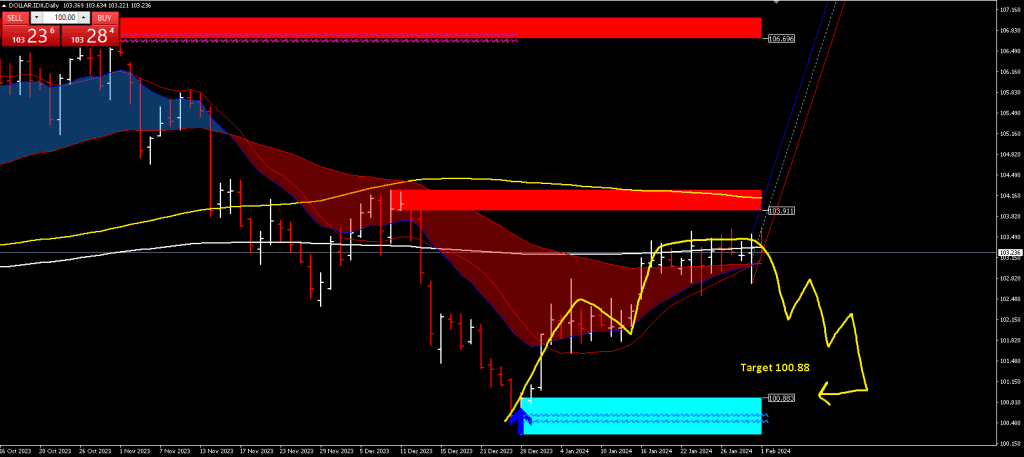

Anticipating the market’s response to potential rate cuts, we project the EUR to regain momentum, potentially reaching previous highs in the next 3 to 6 weeks. Conversely, expectations for the DXY involve a downward trajectory, potentially touching levels around 100.25.

Critical Levels and Support:

Should the EUR decline below the 1.0715 mark, a continuation of the downtrend is expected, with the next significant demand support located around 1.0473. Conversely, a DXY breakthrough above 104.33 may signal a continued ascent, targeting levels around 106.50.

Conclusion:

In this intricate dance of currency markets, traders should remain vigilant. Remember, you are the creator of your trading strategy. Happy Trading!